You can only file for the Foreign Tax Credit (FTC) if your Total Int'l Stock Market is in a Taxable account (so no 401k, 403b, IRA, etc.). Despite the argument that the FTC makes up for the lower tax-efficiency compared to Total US Stock Market, holders of Vanguard's Total Int'l Index got a nasty tax bill recently, so perhaps it's best to hold it in a tax-advantaged account (Roth as first choice and Trad as second choice).Would it matter which account for international tax credits ?

If I did do FTIHX in taxable how would I go about it? Just trade it all at once?

Would FZILX in a Roth, or solo 401k be more efficient since its 0 cost? Or do you think the FTIHX cost is so low it shouldn't matter?

Tax-efficiency Concerns for Total Int'l Funds

viewtopic.php?p=7713711#p7713711

viewtopic.php?t=425731

Typical recommendation is 20-40% or nothing at all. Here's a discussion on why you should have some (vs none at all).I’m thinking of allocating around 20% to international.

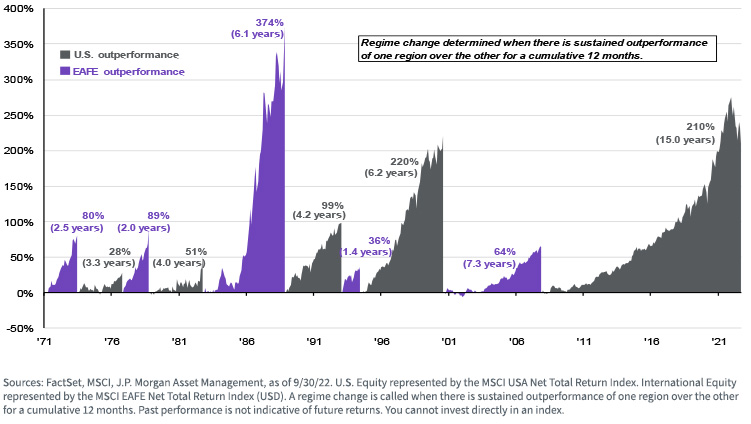

Value of Int'l Diversity from US

There's essentially two camps among Bogleheads: a) Those that are on board with the global market cap weighting, which is about 60% US stock and 40% ex-US stock; and b) those that have a home bias (US will usually outperform), which is about 80% US stock and 20% ex-US stock (some even omit Int'l altogether). I'm in camp a) based on the chart below from WisdomTree, the white paper from Vanguard, and the more recent article from Vanguard.

Vanguard White Paper: International Equity - Considerations and Recommendations

Vanguard Web Article: Making the case for international equity allocations

Statistics: Posted by bonesly — Thu Nov 07, 2024 1:36 am