your question is funds vs stocks, but I think you have to answer first are you asking about actively managed mutual funds or index funds?There appears to be a general consensus from research that picking stocks based on past performance is not recommended. Since most everyone has funds, even those who include individual stocks as a significant portion of their portfolios, the question is whether there is a difference in the research for funds when compared to stocks. Do posters have general attitudes toward any potential differences?

if you're asking if past performance of actively managed funds vs individual stocks is a predictor of their future performance, I'd say there's no evidence of that.

You will find some stocks and actively managed funds that did well in the past and don't do well in the future

You will find some stocks and actively managed funds that did well in the past and do well in the future

You will find some stocks and actively managed funds that didn't do well in the past and don't do well in the future

You will find some stocks and actively managed funds that didn't do well in the past and do well in the future

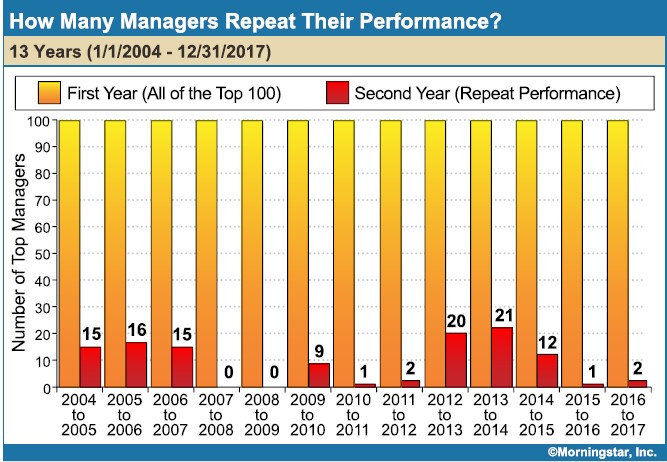

here's a couple of charts that show that active managers often don't repeat their performance:

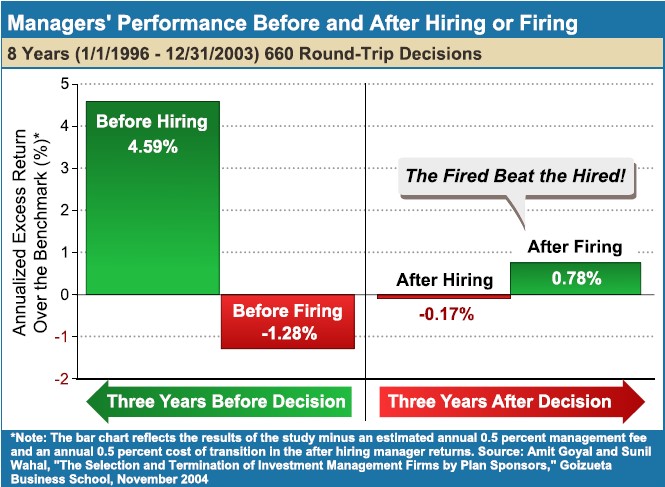

and that often good past performers who are poached often go on to do worse. Then when they're fired for poor performance, they tend to do better after they leave to go to another firm:

Bogle talked about how "the first shall be the last" in his Little Book of Commonsense Investing. He was showing that yesterday's hot funds are tomorrows "not" funds.

Same with stocks. GE did well for a long time, lately, not so much. And so on. See how the Top 10 companies from 1979-2021 have changed over those years. New ones pop up, and old ones leave the top of the heap. You can't predict this stuff.

Now the good part is you can just own the market and get a guaranteed return of the market. You don't have to worry about whether you picked the wrong stocks whose best day was behind them or if you picked the wrong fund manager.

That doesn't mean that past performance is predictive of future performance, at least not in the short term. The long term, perhaps, but even then there's great variety of returns. You can see in the chart below that the returns for various 20 year periods were different from one another, not the same:

And it's often been said that past poor returns pave the way for better future returns and vice versa. After people came of an CAGR of 17.5% from 1980-1999 they assumed great returns for the next decade (AAII investor sentiment survey). Whoops, it turned out to be the "lost decade", real losses of I think 2.5% CAGR from 2000-2009. Then when AAII surveyed people at the depths of the Great Recession in 2009 (when stocks were down -50% from 2007) people said they thought the next decade would produce horrible returns. Wrong again. 2010-2019 gave investors 13.25% CAGR.

Statistics: Posted by arcticpineapplecorp. — Wed Sep 11, 2024 9:34 pm